Precious metals: palladium exceeds gold

According to the latest Commodities focus released last December 2021 by the Studies and Research Department of Intesa Sanpaolo, edited by Daniela Corsini, CFA Economista - Raw Materials, since the beginning of the year the prices of precious metals have decreased. The negative view on gold and silver is caused by more restrictive monetary policies, which leads to a reduction in investment in the two metals. By contrast, partial recovery of platinum and palladium is expected, due to the likely acceleration in demand from the automotive sector. Therefore, as part of a strategic medium-term asset allocation, palladium is preferred to gold.

Gold and silver have suffered downward pressures due to the strengthening of the US dollar and the announcements of anticipation of monetary tightening by the main central banks. Indeed, the expectations of higher rates discourage investment in gold and other non-interest-bearing assets, as they increase the opportunity cost. The negative view on both metals, therefore, depends on the expectation of a monetary tightening that will continue to reduce the propensity to invest in gold in the financial markets. The same goes for silver, not strong enough to be able to decorate from gold, despite the promising long-term fundamentals.

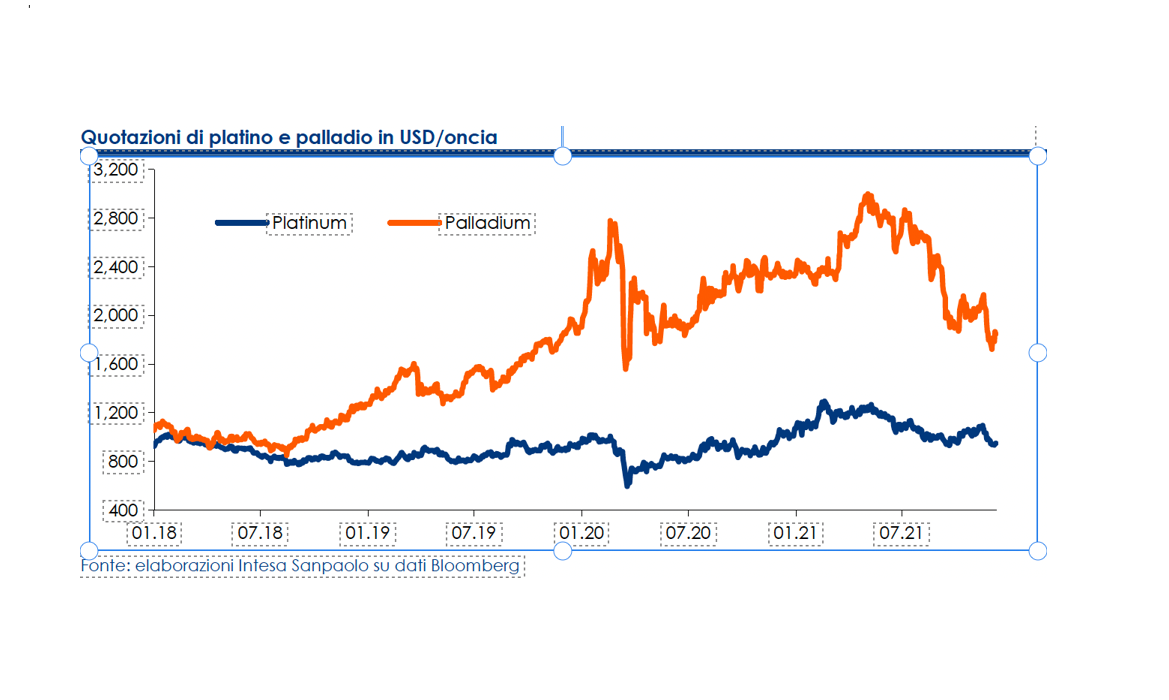

In the second half of 2021, platinum and palladium prices also declined, as the shortage of semiconductors had a more serious negative impact than expected on the production of motor vehicles and, consequently, on the consumption of both metals. Prices are likely to have reached lows and a partial recovery of recent losses is currently expected, due to the likely acceleration in demand from the automotive sector due to the gradual relaxation of the semiconductor crisis.

According to estimates by Johnson Matthey, about 85% of palladium demand comes from catalytic converters used mostly in vehicles with petrol engines, more than 30% of the demand for platinum comes from catalytic converters used mostly in vehicles with diesel engines. Since the beginning of the year, PGM (platinum group metals) have experienced a cycle of expansion and crisis. Indeed, in the first half of the year platinum and palladium outperformed other precious metals, as car manufacturers rapidly increased purchases to supply warehouses and meet new orders, despite the first signs of slowdowns along the production chains due to the lack of semiconductors.

Subsequently, with the passage of time and the consolidation of the world recovery, the shortage of semiconductors has worsened, forcing car manufacturers to revise their production plans downwards and, in some cases, to block some production plants. As a result, demand for PGM has been drastically reduced. Several manufacturers have revised their output forecasts downwards, fuelling pessimism in financial markets and doubts about the future growth of platinum and palladium consumption in the sector.

In the baseline scenario of Intesa Sanpaolo’s Stud Directorate and research, an average price for platinum and palladium for the first quarter of 2022 is assumed to be 1,025 dollars per ounce and 2,000 dollars per ounce, respectively. According to forecasts, in 2022 the quotations could reach an average level close to $ 1,075 for platinum and $ 2,050 for palladium. The palladium may have touched the minima, as the threshold of $1,700 should represent strong support for the metal. By contrast, the minimum of $950 reached in November is weak support for platinum and we believe that the level of $900 constitutes a more solid minimum level.